You're not really earning interest, you collect a portion of the fees for every time someone swaps between the two tokens you're providing. So if no one swaps those two tokens, you don't get shit.

The equation is x*y=k, where x and y are your two tokens, and k is your LP position, which is what V2 is built around where your get XX.X LP tokens depending on x and y provided, and redeem XX.X 'x' and YY.Y 'y' tokens when redeeming it, and yeah, the difference in ratio is what's called "impermanent loss" because theoretically if you withdraw at the same ratio you provided at, you won't lose anything.

EDIT:

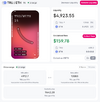

Uniswap Info

This is the pool where I'm providing, so any time you see a "SWAP" at the bottom I get some unclaimed fees in my LP NFT. Some good information here, you can see how much fees the pool is generating per day, the TVL, volume, and liquidity so you can get a feeling of how much you'll be collecting.