Sure, but the fact they didn't mention anything about TRU's July plans (forgive me I forget the details without going back to read your posts) means they don't know about them. Since I'm going on the theory that you James don't have any supersekret1337betainfoz that any site that is purportedly has the job of researching various coins to provide people with information about their future prices does not have, then that means they are talking out of their ass. Reading nothing but price trends and then ass-pulling what prices might be in 5 years based on that in a space as volatile as crypto is pure quackery, IMO.This is exactly right, but it doesn't mean they're entirely wrong. There are no formally announced dates of when tasks are expected to hit Truebit OS on mainnet, but once they do it will affect the price substantially. Until then, standard market conditions are driving the price.

Bitcoins/Litecoins/Virtual Currencies

- Thread starter Tripamang

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Daezuel

Potato del Grande

This is describing 90% of the posts in this thread!Sure, but the fact they didn't mention anything about TRU's July plans (forgive me I forget the details without going back to read your posts) means they don't know about them. Since I'm going on the theory that you James don't have any supersekret1337betainfoz that any site that is purportedly has the job of researching various coins to provide people with information about their future prices does not have, then that means they are talking out of their ass. Reading nothing but price trends and then ass-pulling what prices might be in 5 years based on that in a space as volatile as crypto is pure quackery, IMO.

- 1

Jackie Treehorn

<Gold Donor>

I wasn’t doing yield farming. I was borrowing money on AAVE which yielded greater bonus APY than what you borrowed then constantly reinvesting those coins.What Jackie was doing is called yield farming yeah?

Seems like there is more money in that but obvious risks. (less so with stable coins?)

I've been dragging my heels with staking/yield farming. One point I've heard made is if you're investing to HODL then your expected returns on that over the years will decimate the returns on staking so why take unnecessary risks? That said, I'd still rather have MORE crypto when and if it does BOOM.

- 2

- 1

James

Ahn'Qiraj Raider

- 2,804

- 7,056

Sure, but the fact they didn't mention anything about TRU's July plans (forgive me I forget the details without going back to read your posts)

It's possible in July that Optimism rolls out an optimistic rollup solution utilizing Truebit -- Vitalik outlined how that would operate in a post here: EVM optimistic rollup using Truebit

But there are no formal announcements of that implementation going live, or even if it would be the first to do so. I linked that Zippie CTO interview a couple of pages ago and there's an AMA tomorrow talking more about current barriers to usage and expected implementations, so that should be pretty interesting. It's really easy to make money in crypto by identifying projects like this and buying in before everyone else figures it out, but you gotta look at things like this in the timeframe of years worth of holding -- check out the LINK chart prior to July 2019.

- 1

Lol, perhaps it's a fine distinction, but I consider someone being bullish on a particular thing (TRU and ETH in James' case) based on use cases and looking at market potentials and then using that to predict 5 years out a hell of a lot more credible than someone just looking at a chart and then throwing the bones to divine the price in 2030 which some of the articles I was reading were doing.This is describing 90% of the posts in this thread!

You know what it reminded me of? Those ads for sports betting that used to be on Saturday sports radio when I used to listen to sports radio a few years back before it got woke. Guys literally talking with a straight face about how they had a "LOCK!" on all the games for the weekend and you should totally sign up for our hot tip line so you could know how to bet! If it's a LOCK that means I win right? If you're wrong you'll cover the losses right? hahahaNO. I honestly couldn't believe they were even allowed to have a show, since the government should be banning overt gambling scams like that from being on the air. But hey, it's all clown world now so who knows...

- 1

James

Ahn'Qiraj Raider

- 2,804

- 7,056

I wasn’t doing yield farming. I was borrowing money on AAVE which yielded greater bonus APY than what you borrowed then constantly reinvesting those coins.

This is actually yield farming! A lot of the DeFi ecosystem built up around this exact concept, and I suspect similar opportunities for high rate yield farming when rollups come out.

- 2

- 1

Daezuel

Potato del Grande

Yeah this is my understanding, it's also commonly referred to as liquidity farming?This is actually yield farming! A lot of the DeFi ecosystem built up around this exact concept, and I suspect similar opportunities for high rate yield farming when rollups come out.

- 13,344

- 17,983

I'd stake her.

I'd pump liquidity into that one.

- 1

- 1

James

Ahn'Qiraj Raider

- 2,804

- 7,056

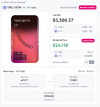

Just created one two nights ago from 4535 TRU/ETH to 10092 TRU/ETH at 1% fee, but closed it out after almost a day because it went just above that 10092 TRU/ETH. This one I created last night, hopefully I don't have to fuck with it at all:

Update almost 24 hours later, collected much less in fees today because TRU was trading at a price with much more liquidity provided.

Attachments

- 13,344

- 17,983

Sure, but the fact they didn't mention anything about TRU's July plans (forgive me I forget the details without going back to read your posts) means they don't know about them. Since I'm going on the theory that you James don't have any supersekret1337betainfoz that any site that is purportedly has the job of researching various coins to provide people with information about their future prices does not have, then that means they are talking out of their ass. Reading nothing but price trends and then ass-pulling what prices might be in 5 years based on that in a space as volatile as crypto is pure quackery, IMO.

Basically. I've seen some pretty quack-ish numbers from those prediction sites. One had VET reaching .40 by 2027 or something after steadily going up by like 3 cents a year from the .22 it was at the time. Now it's .08, but I also think .40 by 2027 is insanely pessimistic (or more accurately, them looking at the existing price trends and pulling numbers out of their ass)

Jackie Treehorn

<Gold Donor>

I’m a dingus — in my head I was thinking of liquidity, not yield farming.This is actually yield farming! A lot of the DeFi ecosystem built up around this exact concept, and I suspect similar opportunities for high rate yield farming when rollups come out.

- 1

- 1

Since AAVE has gone to shit on rates anyone used Polycat Finance or know anything about them?

Haus was if I remember correctly.

Yes, I've been tinkering on Polycat. Right now I was actually using their auto-compounding vaults to put DAI on AAVE through them. Which I am still holding for my stablecoin reserves. Testing the waters on their "pool" function (stake a single coin, earn $FISH) and it's been working as advertised, but unimpressive as the price of $fish has taken a shit over the last 72 hours. I decided to test staking some LP tokens over there, but so far I don't see the benefit of staking my LP tokens there rather than on QuickSwap where I'd also get rewards in $QUICK.

I think as long as the market is in this sideways/recovery mode and volume is suppressed (which it seems to be for all alts) then you're not going to see great yields in farming anywhere.

- 1

Yes, they are consensus mechanisms, and some consensus mechanisms are more decentralized than others. Rock paper scissors is also a 'consensus mechanism'. The question is how many parties are involved and how much influence they have. PoS has fewer participants and has more concentration of influence compared to PoW. In PoS, the stakers are the replacement for the miners who are also the whales whereas in Bitcoin they are much more separated (i.e. miners have a much, much smaller share of the outstanding coins). This greatly increases their influence. (hell, in ETH the developers are are the whales and miners and devs all-in-one) Staking is centralizing not only because all new coins go to the already largest coin holders but also because all but the largest whales must use pools to stake which means they do not have control over their funds while doing this (not your keys etc). If a BTC mining pool went rogue, the miners could switch to another pool in minutes to fight the rogue pool they were just on as their hardware is unseizable by the pool operator. PoS also gives exchanges enormous power. (I hope you trust Binance) PoS blockchains have been successfully attacked by leveraging exchange held coins: The Steem Takeover and the Coming Proof-of-Stake CrisisNo, only idiots say that because Proof of Stake is no more or less "centralized" than Proof of Work, they're consensus mechanisms. Ethereum's Proof of Stake beta chain is deliberately engineered for pooling resources and represents a tiny fraction of expected live staking.

In the cases mentioned in my linked tweets, the pools that blew up were liquid pools, which are an attractive option that allows you to sort of get around the lockup limitation by using another token. (yet another token. tokens to get around the hassle of your other token) If too many stakeholders opt out of staking in a PoS system, because of counterparty risk or fund lock-up or whatever, then the security falls apart, so holders are almost forced to stake. Of course users won't realize this and therein lies another danger.

These guys pooled mainnet ETH on the beacon chain and lost real money. This wasn't test net ETH they got for free from a faucet. They were liquid pools which are smaller and more experiemental but were still mainnet pools. This counterparty risk is simply absent from PoW mining.

To be fair, decentralized staking pools will probably happen one day, just as decentralized mining pools are on the horizon. Also PoS can be 'good enough' security for DeFi chains IMO so long as Bitcoin is there to be the final safe haven long-term store of value destination, so I do own some PoS coins. I'm not suggesting ETH is guaranteed to fail.

- 1

Lolz. Just found this. Good thing my position in the PoS coin I own (Radix) is small I guess. I'm rooting for them though

“StakeHound is a revolutionary DeFi product that prevents users from having to choose between securing layer 1 protocols and participating in the DeFi application ecosystem”,” said Piers Rydiard, CEO of Radix. “Their institutional-grade custody and staking, along with their liquid staked tokens will increase liquidity and security for the Radix network as well as the liquidity of the other communities we are working closely with in the Ethereum DeFi ecosystem.”

Share: