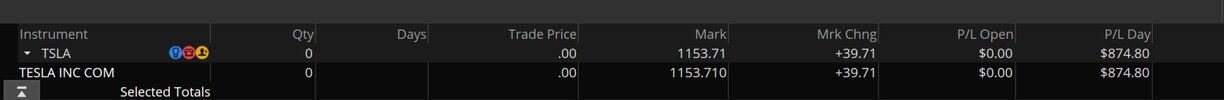

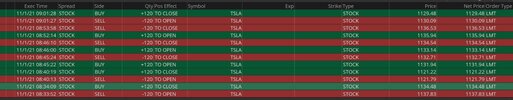

$50-100k. I started out scalping and adjusted strategies over time what clicked most for me has been selling put options and swing trading. I made some heavier returns early but was highly sporadic had larger % gains and losses, more down months. I have become rather proficient at avoiding draw downs but that does hamper potential returns. I look for about half the beta of the market while capturing 80% of its performance. I perform best in volatile markets, underperform the market the worst during boring melt ups. So years like 2017 and this one tend to be rough. This year working for me points to how the learning process never ends, I looked at mistakes I made in 2017 and my read was that we were going to have a very similar year and was able to use months like March and Oct to perform better than I would have in 2017 (only made 7% in 2017 OUCH waiting for pullbacks that never came).

It has been a challenge to read data well enough to know when to pounce on 3-5% pullbacks vs the more standard 7-10% corrections. Lots goes into building positions that allow me flexibility, I know I achieve it when I'm both rooting for the market to drop and perfectly satisfied when it doesn't.

Part of why this works for me is because I've reached an asset level that I no longer need higher returns, allows me to take the path of least resistance/risk. If my future wasn't financially secured I would take more risk. In my first decade trading I averaged 59.73% return, but I was trading with amounts that could easily be replaced with income. Even for that decade the returns are skewed, because in 2002 I made 260.38%, sounds super exciting but I made $23,660 that year. I was happy to go from $9,087 to start and $32,747 at year end, but had I lost that $10k it would not have had much material impact on me, but probably would have psychologically. I have never topped that year since and I never will, I wasn't a better trader then I was far worse.

In the last decade I have averaged 16.55% so I'm pretty sure I"m losing to the nasdaq, not sure about SPY. I have minimal drawdowns compared to the market during that period and I definitely feel like a much better trader now. In the next 10 yrs my avg return will be even lower, I'd imagine below 12%. I sure hope to continue to learn and adapt but I'll likely apply that learning towards controlled risk rather than trying to make more. I have talked to the wife about once we hit a certain NW threshold taking any money I have over that and simply trade without such regard to risk, and that could probably be a lot of fun for me.