Stocks will fall to 13500-14500 then recover to around 16k in 2023. You will never see _____ again in your lifetimes.

- 2

- 1

Stocks will fall to 13500-14500 then recover to around 16k in 2023. You will never see _____ again in your lifetimes.

For the memes?Part of me thinks I should sell it all, harvest the loss, and yolo it all into TQQQ.

I am intriguedPart of me thinks I should sell it all, harvest the loss, and yolo it all into TQQQ.

Part of me thinks I should sell it all, harvest the loss, and yolo it all into TQQQ.

That book wasn't on my list. I may check it out if you liked it.

In order of impact for me, personally:

- Trade Mindfully by Gary Dayton

- Trading in the Zone by Mark Douglas

- The Art and Science of Technical Analysis by Adam Grimes

- Antifragile by Nassim Taleb

- The Candlestick Course by Steve Nison

- Principles by Ray Dalio

- Market Wizards by Jack Schwager

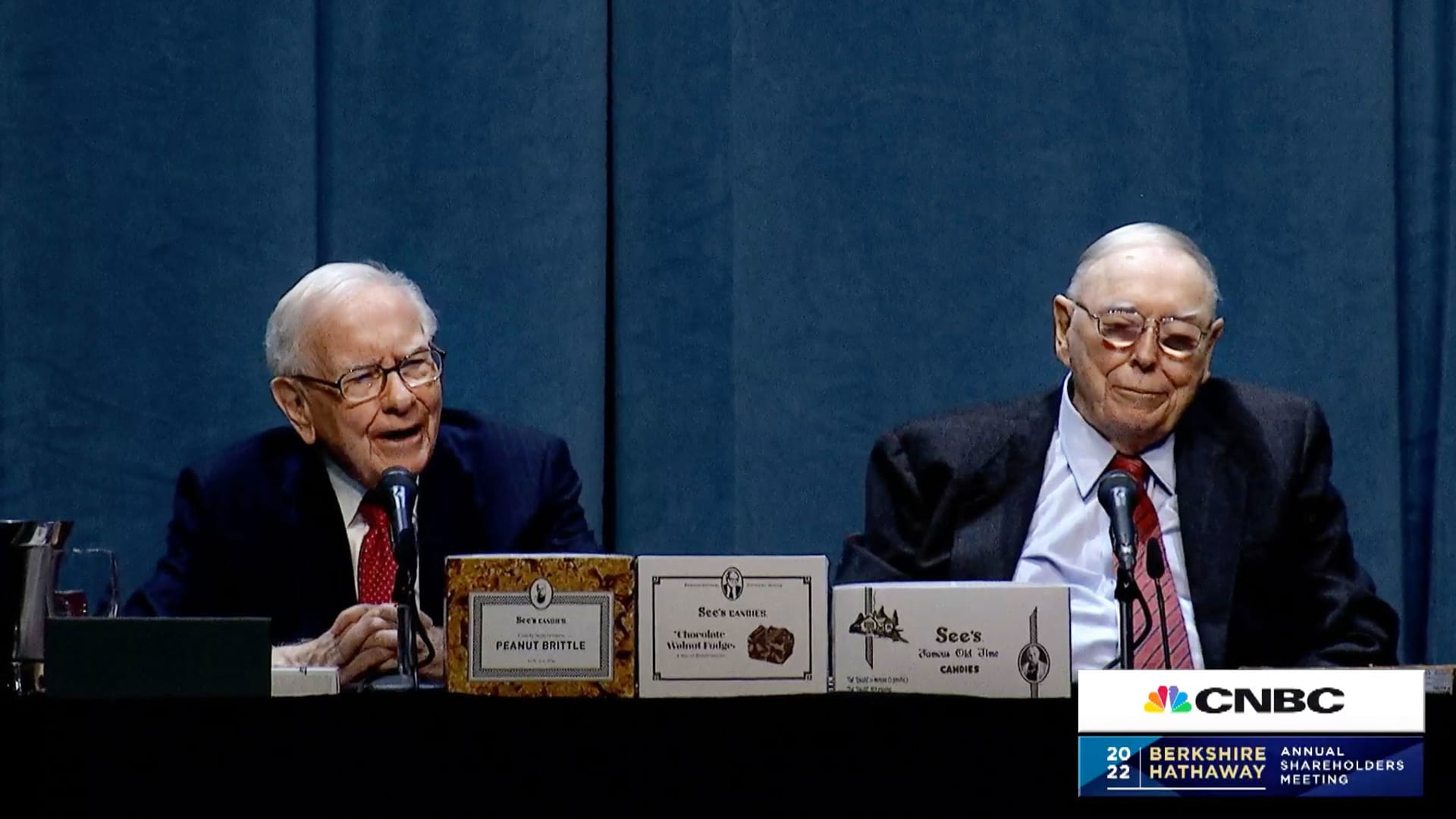

Wisdom from the Master of Coin. The only addendum I add is I will sell if the company's management goes off the reservation. See: DIS

AMZN getting downgrades will not be helping the indexes today.SPY just punched through the year's lows here premarket. Long way till the open, but I would not be surprised we see more panic.

Also note: FOMC Tues-Weds.

Here is a 3-year chart. I am not using 2-years anymore since Covid Black Monday has dropped off. The stock exploded in 2022 so it needs to come back to some sense of normalcy and i think it is going to require patience. Friday's low was $139.93. My thought is I would like it at the 200 DMA ($129.36) as it has some nice support there. The trick is I don't know if it will get there. That would be a 25% drop from its parabolic high of $175. If it doesn't recapture the 100-DMA of $145.43 then it might keep drifting down. The price downgrades today aren't going to help it. It has solid support at $135 and my guess is that will be its next stop if it cant climb above the 100-DMA.Hmm, good question. I'm thinking something like 130, but that might be too much depending on how things go. 120 maybe?

Let's see if Sanrith agrees